AMIS CEO, Alex Liu

Blockchain technology has outgrown its origins in digital currency to become a medium realizing the “Internet of Value,”whereby tokens representing money, property, and deeds can be transferred over the Internet in a peer-to-peer fashion, just as email is. With a diversified economy that lacks global-scale players in many sectors, Taiwan is ideally suited to harness the potential of blockchain technology by tying together sectors such as finance, telecommunications, energy, and retail in a seamless applications framework. Autonomous vehicles that can rent themselves out and pay for their own maintenance, or an energy grid that fully accommodates renewable energy sources and time-of-day pricing are on the roadmap. AMIS seeks to harness homegrown technology talent and global connections to realize this vision.

The TSMC of Fintech

ITRI helped incubate TSMC in the 1980s and in so doing set in motion a fundamental restructuring of the global semiconductor industry. By focusing on the capital-intensive aspects of semiconductor manufacture, and publishing an “API”(the so-called Process Design Kit) for startups such as Qualcomm, MediaTek, and Nvidia to design on, TSMC spawned an entirely new creative sector called the“fabless semiconductor industry.”

Between 1987, the year TSMC was founded, and 2015, these fabless semiconductor companies grew to occupy over 20% of the market, pioneering new sectors such as graphics processors and broadband mobile communications, while vertically-integrated (largely Japanese) semiconductor manufacturers surrendered corresponding market share. During the process, Taiwan placed 3 companies among the top 20 worldwide, up from none in 1987.

Due to blockchain technology, the finance industry is undergoing a similar structural shift. Transaction processing, formerly the sole domain of closed, centralized systems, is coming into the purview of Internet-based, peer-to-peer systems. This creates a tremendous opportunity to onboard entirely new classes of entities into this system, including IoT solution providers, telecommunications companies, and regulators, who will now have a real-time view into transactions and who can now automate many compliance procedures. What the Internet did for text, voice, and video communications, it will now do for financial transactions.

AMIS’ambition is no less than to become the TSMC of financial technology. By straddling the worlds of traditional finance and technology, we believe we can effectuate an API for value transfer that will enable new generations of companies to innovate financial use cases without having to be burdened by the capital requirements of traditional players. It may be Tesla who will enable their self-driving vehicles to pay each other and thus provide prioritized service along congested roadways, or Taipower who can buy electricity from solar panels during the day and sell power to households at night. In each case, neither Tesla nor Taipower needs to become a financial service provider themselves – they just need to program to a blockchain API.

Tight Integration with Financial Sector

In order to provide this API and fulfillment service to non-financial players, AMIS will need to tightly integrate itself with financial institutions, who still have custody of money and have ultimate settlement and risk control responsibilities. Just as TSMC had to become a manufacturer itself in order to alleviate that burden for startup companies, AMIS will most likely have to become part of the regulated financial sector in order to alleviate such burdens for non-financial companies. Through doing so, it will introduce new capabilities and possibilities for incumbent financial institutions, including regulators.

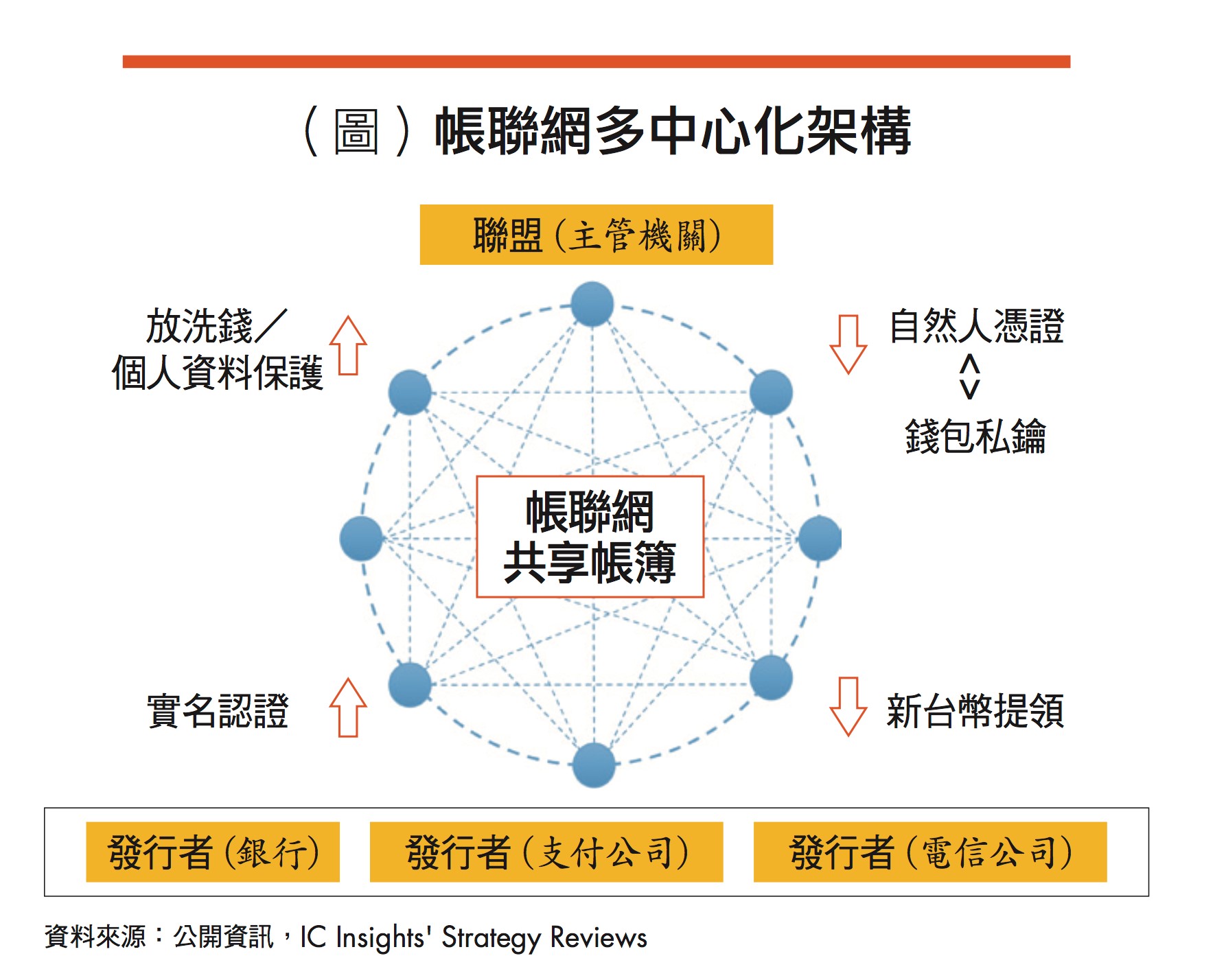

帳聯網多中心化架構

帳聯網多中心化架構There are differences of course between the manufacturing and Internet sectors on the one hand, and finance on the other. In particular, finance is perhaps the most heavily regulated industry in the world. Moreover, unlike the Internet, finance has very clearly delineated geographic boundaries because of the regional nature of fiat currencies. In its bid to become the TSMC of financial technology, AMIS will have to conform with this reality. That is where being locally rooted, yet globally connected, will become of key importance to AMIS. Helping to enforce local tax and monetary policies, yet being able to transact globally with other blockchain networks will be a key feature of this new infrastructure.

To this end, AMIS is a founding member of the recently formed Enterprise Ethereum Alliance, which ranks alongside Hyperledger and R3 as one of the main blockchain technology consortia in the world. These global standards will effect interoperability between local blockchain networks. At the same time, AMIS has a tight partnership with ITRI and universities such as National Chengchi University and National Taiwan University, as well as with Taiwanese financial institutions, to realize the localization of processes and regulations. This local yet global approach is key to success in the blockchain world, which shares the global traits of other Internet services, but add the locally regulated nature of financial services.

Taiwan: An Ideal Incubator

Apart from a few manufacturers in electronics, Taiwan has very few global-scale players, and none in electronic payments. Instead, Taiwan is often on the receiving end of global developments, such as the entry of Alipay or Apple Pay into the local market. In both cases, not only does Taiwan play a passive role in the development, local entities have no access to the data generated from the transactions – oftentimes the most valuable asset of all. In order to ameliorate this, AMIS has partnered with ITRI and local financial institutions such as Fubon and Taishin to create 帳聯網 – a blockchain-based payment system especially well suited to cross-industry and cross-application micro-payments.

This new infrastructure, which will operate within the new regulatory sandbox being set up by the Financial Supervisory Commission, will allow renewable energy companies, telecommunication service providers, and public utilities to transact with banks, insurance, and securities companies just as easily as they currently send emails to each other. All the while, it leaves the custody of money in the most suitable place – in banks –and upgrades the capabilities of regulators to track and analyze transactions.

Taiwan is the ideal incubator for such an effort, since while it lacks the global reach of financial centers such as Hong Kong and Singapore, it does have a very well-balanced economy, especially in the technology sector. This inherently interdisciplinary approach enabled by blockchain technology and Internet protocols also plays to the strengths of new players such as AMIS, as well as broadly capable research institutions such as ITRI. With 帳聯網, Taiwan has the opportunity to leapfrog incumbents in electronic payments and other financial services and enter the peer-to-peer Internet world ahead of them.

A Problem of Inertia

While the possibility exists for Taiwan to use blockchain to effect a paradigm shift in financial services just as it did for the semiconductor industry four decades ago, this is not a greenfield exercise as it was for semiconductors. There are existing payment and settlement systems, many of them connected to international networks. While all of them are of a centralized nature and run on closed systems, they process hundreds of billions of dollars in transactions yearly. They thus represent significant vested interests, some of which are shared by the national government.

This situation is akin to the one in the United States in 1977, when the U.S. Postal Service petitioned the Carter Administration for a license to operate a national email system. The USPS retained RCA for $2.3 million USD (about $10 million USD in current dollars) to build an email system that ended up being electronic between post offices, but still relied on human carriers for the last mile of delivery. This was done to fend off the incipient competition email represented for first-class mail (and postage stamp sales) but even the USPS gave up on this effort in 1979 and opened up email services to private enterprise.

Taiwan’s government now faces a similar decision as to whether to prolong the monopoly of existing clearing and settlement entities, or to allow private enterprise to offer competing as well as complementary services. Just as the development of the Internet led to e-commerce and exploding parcel business for the post office (while also bringing pressure to the sale of postage stamps), so the development of blockchain-based financial services will represent both challenges and opportunities for the incumbent entities.

History's Lesson

As the last two decades of Internet development have taught us, open protocols and competition lead to much improved outcomes for society, while not negating the need for incumbent services. AMIS, as the leading blockchain technology company in Taiwan, hopes that the government will have the wisdom and foresight to allow a similar dynamic to unfold here, and create massive new wealth for society. Having been largely left out of the Internet 1.0 and 2.0 waves of innovation, Taiwan will hopefully lead the Internet of Value revolution.

Taiwan had the vision to identity and create an entirely new industry out of nothing four decades ago in semiconductors. ITRI played a key role in incubating TSMC and other semiconductor leaders. In so doing, it led to the creation of countless new companies and applications. With blockchain technology, we similarly have the opportunity to separate the capital-intensive aspects of financial custody and settlement from the open and creative aspects of application development. AMIS looks forward to co-creating with our public- and private-sector partners such an Internet of Value, at first within Taiwan, and then, globally.

相關連結: 回169期_FinTech & 區塊鏈 專輯